Register for Class Today!

Coming soon...

Or Select

What this fees includes:

- Note: Total fee must be paid prior to class sessions.

- This fee include the book and access to the online portal.

- The course offered are subject to cancellation in the event of insufficient enrollment.

- Completion of the course does not guarantee employment, nor are graduates required to work for the company.

Income Tax Preparation Course Bilingual Textbook

This course is a bilingual (English & Spanish) basic overview of tax preparation. And, it's only available in the Fall of every year. Prior tax knowledge is not a requirement to take the course. This 15-chapter book is a basic overview of the Form 1040. At the end of each chapter, you will answer the chapter review questions and prepare a practice tax return. You must complete all the chapters, the final review questions and each practice tax return to receive a Certificate of Completion for the course. Everyone that successfully completes the course, is responsible for completing a new or a renewal application with the IRS for the IRS Tax Preparer Identification Number (PTIN) before the 31st of December of every year.

Tax Preparation Course What You'll Learn in Our Course

- Prepare most individual tax returns

- Perform a thorough interview with a taxpayer

- Determine a taxpayer's filing status and eligibility for exemptions

- Accurately report income and deductions for a taxpayer

- Determine a taxpayer's eligibility for credits and deductions

- Compute depreciation for assets and eligibility for Section 179

- Accurately calculate a taxpayer's refund or balance due

- Advise a taxpayer in tax planning strategies

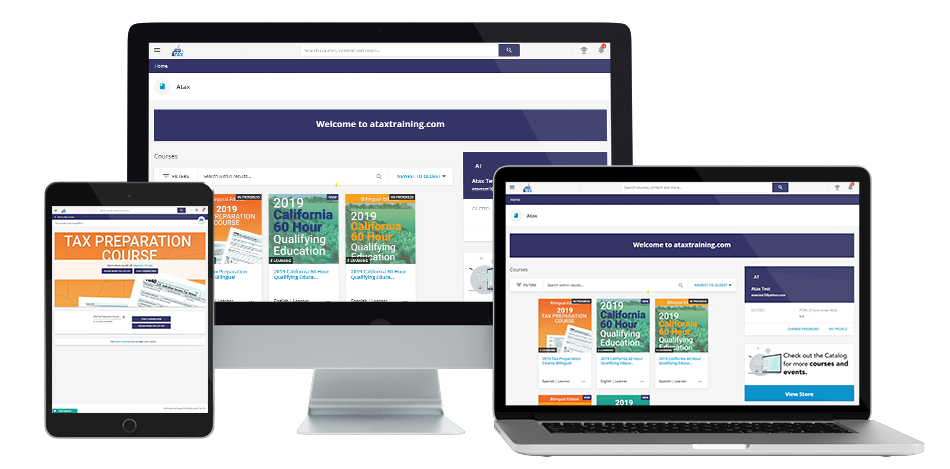

Web-based Portal

Online Portal for Tax Preparation

Practice Activities

After reading each chapter you will have to login to your own online portal to answer the review questions related to the material that you read, and to prepare practice tax returns. Also, you will be able to download the PDF practice tax return scenarios and the necessary forms to prepare the tax returns by hand. You will then answer questions related to the tax preparation.

Follow Purnell Wright, Jr. PhD Finance Student

Meet Your InstructorPurnell Wright, Jr. PhD Finance Student

Class Leader of ATAX - Palmyra NJ

Purnell enjoys learning and educating others in the field of finance. Purnell is TRULY a Professional student. He is active in several non-profit and church boards, providing spiritual, managerial guidance, and financial acumen. Purnell is ordained as an Elder and has helped several Pastors build congregations. Through years of fighting Polycystic Kidney Disease, he has started a non-profit organization called My Friend Needs Kidney. He plays tennis, enjoys gardening, and cycling. In his spare time and helps those with special needs and mentors youth.

B. Purnell Wright, Jr. (Doctornal Finance Student) B. PurnellWright, Jr. MFS, FEPS., Purnell has a Master's in Finance and is pursuing a Ph.D. in Finance from Walden University. He has over 30 years in the finance industry as CEO of a Mortgage Banker/Broker Company. Moreover, Purnell is licensed by the Department of Banking and Insurance in Financial and Retirement Planning. Education is essential to him. In addition to his current credentials, he is pursuing the IRS designation as an Enrolled Agent. He has 5-7 years as an instructor for the Federal Government and the Public School District in the tri-state area. As CEO of Atax Franchise in Palmyra, New Jersey, a full-service accounting firm, he brings these years of experience and provides tax preparation, tax planning, bookkeeping, payroll and company registration services, personal and & Business tax, and free ITINs. Unlike other firms, Atax Palmyra NJ is open all year round to service your Personal and Business needs. He has learned that there is a solution for every situation. His life goal is to make his client's hopes tangible. Please call 856-899-5703 for a confidential consultation.

Have Questions? Call Us Today (856) 899-5703