Register for Class Today!

Coming soon...

Or Select

What this fees includes:

- Note: Total fee must be paid prior to class sessions.

- This fee include the book and access to the online portal.

- The course offered are subject to cancellation in the event of insufficient enrollment.

- Completion of the course does not guarantee employment, nor are graduates required to work for the company.

Income Tax Preparation Course Bilingual Textbook

This course is a bilingual (English & Spanish) basic overview of tax preparation. And, it's only available in the Fall of every year. Prior tax knowledge is not a requirement to take the course. This 15-chapter book is a basic overview of the Form 1040. At the end of each chapter, you will answer the chapter review questions and prepare a practice tax return. You must complete all the chapters, the final review questions and each practice tax return to receive a Certificate of Completion for the course. Everyone that successfully completes the course, is responsible for completing a new or a renewal application with the IRS for the IRS Tax Preparer Identification Number (PTIN) before the 31st of December of every year.

Tax Preparation Course What You'll Learn in Our Course

- Prepare most individual tax returns

- Perform a thorough interview with a taxpayer

- Determine a taxpayer's filing status and eligibility for exemptions

- Accurately report income and deductions for a taxpayer

- Determine a taxpayer's eligibility for credits and deductions

- Compute depreciation for assets and eligibility for Section 179

- Accurately calculate a taxpayer's refund or balance due

- Advise a taxpayer in tax planning strategies

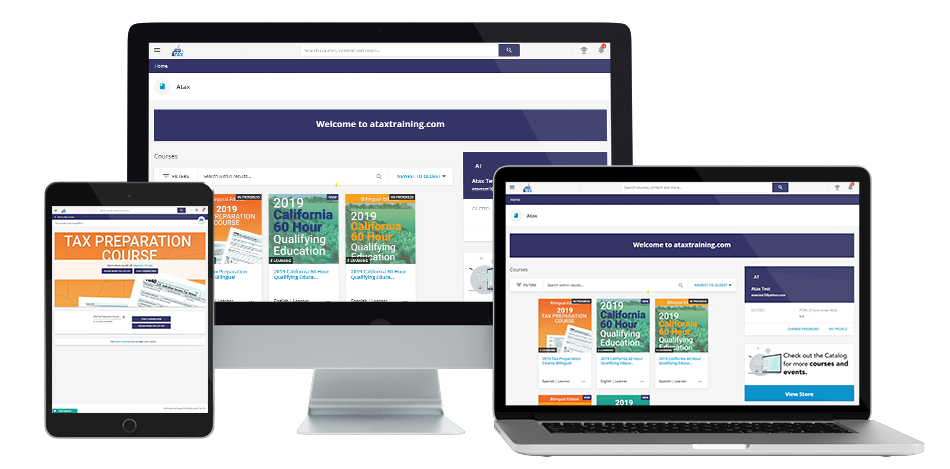

Web-based Portal

Online Portal for Tax Preparation

Practice Activities

After reading each chapter you will have to login to your own online portal to answer the review questions related to the material that you read, and to prepare practice tax returns. Also, you will be able to download the PDF practice tax return scenarios and the necessary forms to prepare the tax returns by hand. You will then answer questions related to the tax preparation.

Follow Bonnie Yam

Meet Your InstructorBonnie Yam

Class Leader of ATAX - Bellmore NY

Learning about how to file taxes can assist you in understanding the US tax system. What is income? What are deductions? How are you taxed? Understanding this can help you build a better financial future. We are always looking for competent tax filers. If you are interested in a seasonal or permanent job for additional revenue, you should really take this class. Start now!

Bonnie Yam, CFA, CFP, AIF, CLU, ChFC, CLSP, RICP, EA, CVA, CEPA, CM&AP Ms. Yam graduated from Smith College with a BA in Math and Economics. She received her MBA in finance from University of Chicago. She was a financial manager for TIME magazine and a Hedge Fund Analyst for Cheetah Investment. Ms. Yam has been in the pension consulting business for 20 years and 8 years in Business Evaluation. She owns her own RIA, Pension Maxima. She is a Business Evaluator and assisted estate attorneys, tax attorneys in evaluating complex business deals. Currently, She is an Area Representative of ATAX, a rapidly expanding tax franchise in U.S. Ms. Yam is highly involved with educating the community. She is a CPA CPE sponsor in NY and NJ and has lectured extensively on Financial Wellness Topics through FPA, NYSSCPA and at NY SIBL library. She is also adjunct professor at SUNY University on Financial Wellness topics for individual and business owners. She is also an On-Demand Personal Financial Consultant for Magellan Federal, a program servicing the US Military. She has also built an online learning program www.financialwellnesstower.com Awards: Marquis Who’s Who, Wealth & Finance: Most Supportive Retirement Structure Platform – New York Affiliations: Member: CFA Institute, Westchester Business Council, Westchester County Association (Intel Committee), Westchester County MWBE Task Force, New York Financial Planning Association, Exit Planning Institute, NY CPA Association, Chinese CPA Association

Have Questions? Call Us Today (516) 596-8842