Register for Class Today!

Coming soon...

Or Select

What this fees includes:

- Note: Total fee must be paid prior to class sessions.

- This fee include the book and access to the online portal.

- The course offered are subject to cancellation in the event of insufficient enrollment.

- Completion of the course does not guarantee employment, nor are graduates required to work for the company.

Income Tax Preparation Course Bilingual Textbook

This course is a bilingual (English & Spanish) basic overview of tax preparation. And, it's only available in the Fall of every year. Prior tax knowledge is not a requirement to take the course. This 15-chapter book is a basic overview of the Form 1040. At the end of each chapter, you will answer the chapter review questions and prepare a practice tax return. You must complete all the chapters, the final review questions and each practice tax return to receive a Certificate of Completion for the course. Everyone that successfully completes the course, is responsible for completing a new or a renewal application with the IRS for the IRS Tax Preparer Identification Number (PTIN) before the 31st of December of every year.

Tax Preparation Course What You'll Learn in Our Course

- Prepare most individual tax returns

- Perform a thorough interview with a taxpayer

- Determine a taxpayer's filing status and eligibility for exemptions

- Accurately report income and deductions for a taxpayer

- Determine a taxpayer's eligibility for credits and deductions

- Compute depreciation for assets and eligibility for Section 179

- Accurately calculate a taxpayer's refund or balance due

- Advise a taxpayer in tax planning strategies

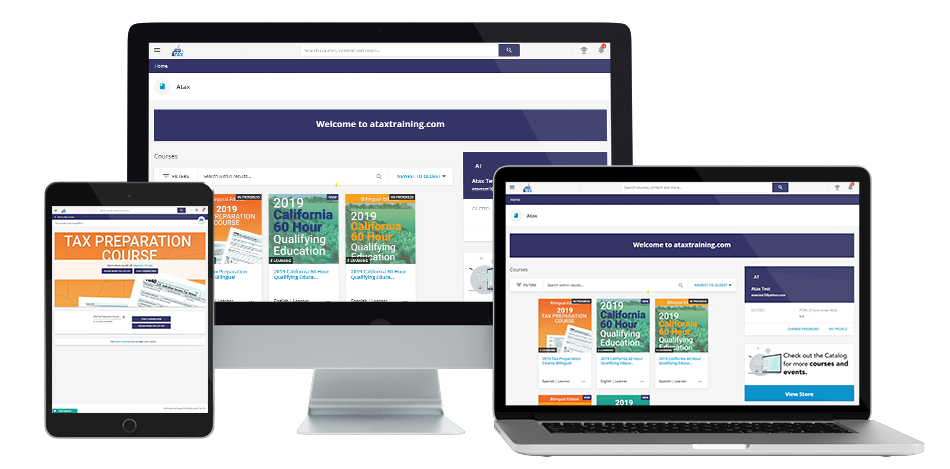

Web-based Portal

Online Portal for Tax Preparation

Practice Activities

After reading each chapter you will have to login to your own online portal to answer the review questions related to the material that you read, and to prepare practice tax returns. Also, you will be able to download the PDF practice tax return scenarios and the necessary forms to prepare the tax returns by hand. You will then answer questions related to the tax preparation.

Follow Kiani Alvarez

Meet Your InstructorKiani Alvarez

Class Leader of ATAX - Marble Hill, Bronx, NY

Vice President of ATAX Marble Hill. My focus has always been to educate the community and to help people grow to be the best that they can be!

Kiani Alvarez graduated with a bachelor's degree in Marketing and Communications from Cortland State University. She spent a year studying in Europe in the City of Sevilla, Spain. She started her professional career supporting ATAX Franchisees and helping them become successful in marketing their offices to help grow their clientele to the next level. She has taken the tax preparation course many times and has worked along side the staff at ATAX Marble Hill helping her father, Rafael Alvarez, the founder and CEO of ATAX Franchise to take the family business to the next level. Kiani then became the Vice President of ATAX Marble Hill working along side her sister to help run the largest latino owned tax office in the nation!

Have Questions? Call Us Today (718) 889-3100