Register for Class Today!

| Group | Start/End Date | Days | Time | Language | Type |

| 2415 | 13 May 2025 - 29 May 2025 | Tuesdays & Thursday | 7:00 PM - 10:00 PM | Spanish | Online |

Or Select

What this fees includes:

- Note: Total fee must be paid prior to class sessions.

- This fee include the book and access to the online portal.

- The course offered are subject to cancellation in the event of insufficient enrollment.

- Completion of the course does not guarantee employment, nor are graduates required to work for the company.

Income Tax Preparation Course Bilingual Textbook

This course is a bilingual (English & Spanish) basic overview of tax preparation. And, it's only available in the Fall of every year. Prior tax knowledge is not a requirement to take the course. This 15-chapter book is a basic overview of the Form 1040. At the end of each chapter, you will answer the chapter review questions and prepare a practice tax return. You must complete all the chapters, the final review questions and each practice tax return to receive a Certificate of Completion for the course. Everyone that successfully completes the course, is responsible for completing a new or a renewal application with the IRS for the IRS Tax Preparer Identification Number (PTIN) before the 31st of December of every year.

Tax Preparation Course What You'll Learn in Our Course

- Prepare most individual tax returns

- Perform a thorough interview with a taxpayer

- Determine a taxpayer's filing status and eligibility for exemptions

- Accurately report income and deductions for a taxpayer

- Determine a taxpayer's eligibility for credits and deductions

- Compute depreciation for assets and eligibility for Section 179

- Accurately calculate a taxpayer's refund or balance due

- Advise a taxpayer in tax planning strategies

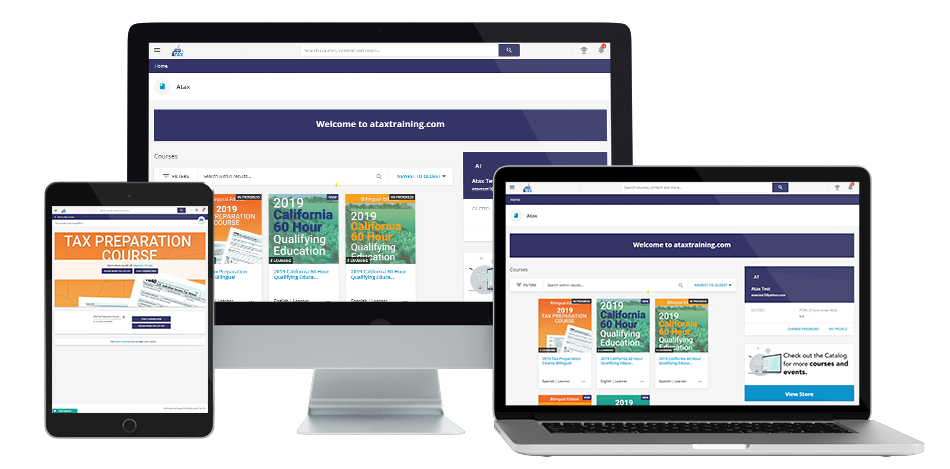

Web-based Portal

Online Portal for Tax Preparation

Practice Activities

After reading each chapter you will have to login to your own online portal to answer the review questions related to the material that you read, and to prepare practice tax returns. Also, you will be able to download the PDF practice tax return scenarios and the necessary forms to prepare the tax returns by hand. You will then answer questions related to the tax preparation.

Follow Arlenys Nunez

Meet Your InstructorArlenys Nunez

Class Leader of ATAX - Bedford Park, NY

My job is to encourage others to learn and grow.

Arlenys Cristina Nunez is the Manager and Director of ATAX Cloud Bookkeeping New York, NY since 2015. Mrs. Nunez is the tax practitioner, payroll manager, and bookkeeper at this ATAX location. Her knowledge, expertise, and excellent customer service is undeniable. Also, she is an ATAX Franchise owner. ATAX is a full-service national tax preparation and business services franchise with over 30 years of experience and locations nationwide. Focusing more on people than just numbers, Atax Cloud bookkeeping has helped many business owners reach their goals. We are proud to say that their efforts since 2015 are paying off. As an ATAX franchisee, the main interest is to develop, teach, and grow a knowledgeable community. This commitment to the community is the main reason why teaching this Tax Preparation Class is so important for Arlenys as well as encouraging others to learn and grow. ATAX Cloud bookkeeping is open all year round, with a focus on bookkeeping and accounting for small businesses. Their tax preparation services include personal taxes, corporate taxes, sales taxes, self-employment taxes, and payroll taxes. Also, we incorporate new companies, acquire business certificates, and draft business plans for all types of businesses.

Have Questions? Call Us Today (917) 983-5195