Register for Class Today!

Coming soon...

Or Select

What this fees includes:

- Note: Total fee must be paid prior to class sessions.

- This fee include the book and access to the online portal.

- The course offered are subject to cancellation in the event of insufficient enrollment.

- Completion of the course does not guarantee employment, nor are graduates required to work for the company.

Income Tax Preparation Course Bilingual Textbook

This course is a bilingual (English & Spanish) basic overview of tax preparation. And, it's only available in the Fall of every year. Prior tax knowledge is not a requirement to take the course. This 15-chapter book is a basic overview of the Form 1040. At the end of each chapter, you will answer the chapter review questions and prepare a practice tax return. You must complete all the chapters, the final review questions and each practice tax return to receive a Certificate of Completion for the course. Everyone that successfully completes the course, is responsible for completing a new or a renewal application with the IRS for the IRS Tax Preparer Identification Number (PTIN) before the 31st of December of every year.

Tax Preparation Course What You'll Learn in Our Course

- Prepare most individual tax returns

- Perform a thorough interview with a taxpayer

- Determine a taxpayer's filing status and eligibility for exemptions

- Accurately report income and deductions for a taxpayer

- Determine a taxpayer's eligibility for credits and deductions

- Compute depreciation for assets and eligibility for Section 179

- Accurately calculate a taxpayer's refund or balance due

- Advise a taxpayer in tax planning strategies

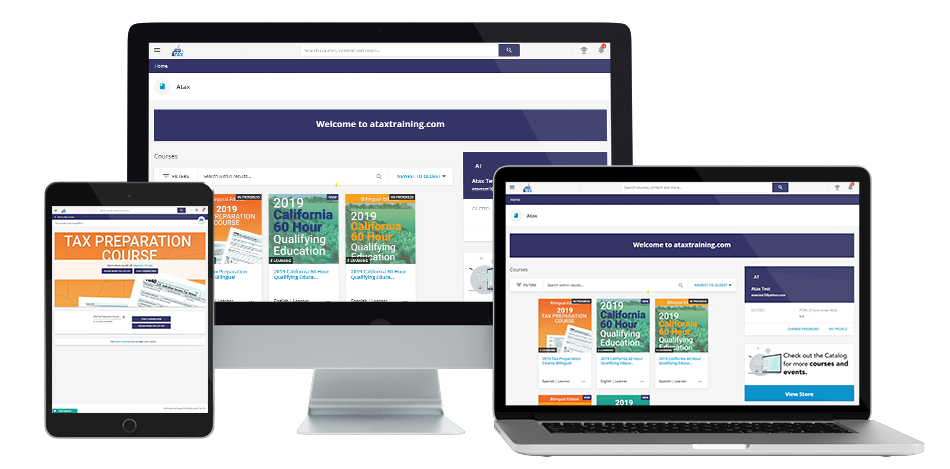

Web-based Portal

Online Portal for Tax Preparation

Practice Activities

After reading each chapter you will have to login to your own online portal to answer the review questions related to the material that you read, and to prepare practice tax returns. Also, you will be able to download the PDF practice tax return scenarios and the necessary forms to prepare the tax returns by hand. You will then answer questions related to the tax preparation.

Follow Digna Cueto, EA

Meet Your InstructorDigna Cueto, EA

Class Leader of ATAX - Woodside, NY

Digna Cueto, EA, is a seasoned business professional with over 20 years of experience in the corporate retail industry. Since 2018, she has built extensive expertise in the tax preparation field. As an IRS Enrolled Agent, she is federally authorized to represent taxpayers before the IRS and brings expert knowledge in tax law and compliance. An accomplished entrepreneur, Digna leads a thriving business that provides comprehensive services including tax preparation, bookkeeping, and payroll. She is also a respected instructor at a reputable tax preparation school, where she shares her expertise with aspiring tax professionals.

Digna Cueto, EA Digna Cueto is a seasoned business professional with over 20 years of experience in the corporate retail industry. Since 2018, she has been at the helm of her own practice, providing accurate tax preparation, bookkeeping, and payroll services, along with professional training through her tax school. As an IRS Enrolled Agent (EA), Digna is federally authorized to represent taxpayers before the IRS and is recognized for her expertise in handling complex and sensitive tax matters. She also serves as an esteemed instructor at a reputable tax preparation school, where she is committed to educating and mentoring the next generation of tax professionals. Digna holds degrees in Engineering and Business Administration, along with 18 credits in accounting. She is also certified as a Registered Tax Preparer (RTP) and a Certified Acceptance Agent (CAA) with the IRS. Her passion lies in helping individuals resolve difficult tax situations, especially those involving inaccurate or problematic filings. As the owner of ATAX Woodside NY, a trusted franchise backed by the robust resources and support of the ATAX network, Digna provides high-value financial services to the Queens, NY community. Her commitment to excellence ensures that clients receive reliable, personalized assistance every step of the way. Beyond her professional accomplishments, Digna is deeply committed to empowering others and making a positive impact. Her compassionate approach reflects her belief in helping people navigate financial challenges with confidence and clarity.

Have Questions? Call Us Today (917) 473-3275