Register for Class Today!

| Group | Start/End Date | Days | Time | Language | Type |

| 2456 | 20 Sep 2025 - 01 Nov 2025 | Saturdays | 10:00 AM - 2:00 PM | Bilingual | InPerson |

| 2457 | 15 Nov 2025 - 20 Dec 2025 | Saturdays | 10:00 AM - 3:00 PM | Bilingual | InPerson |

Or Select

What this fees includes:

- Note: Total fee must be paid prior to class sessions.

- This fee include the book and access to the online portal.

- The course offered are subject to cancellation in the event of insufficient enrollment.

- Completion of the course does not guarantee employment, nor are graduates required to work for the company.

Signup and Submit Payment

Please enter your credit or debit card information below to submit your deposit or make full payment.

Income Tax Preparation Course Bilingual Textbook

This course is a bilingual (English & Spanish) basic overview of tax preparation. And, it's only available in the Fall of every year. Prior tax knowledge is not a requirement to take the course. This 15-chapter book is a basic overview of the Form 1040. At the end of each chapter, you will answer the chapter review questions and prepare a practice tax return. You must complete all the chapters, the final review questions and each practice tax return to receive a Certificate of Completion for the course. Everyone that successfully completes the course, is responsible for completing a new or a renewal application with the IRS for the IRS Tax Preparer Identification Number (PTIN) before the 31st of December of every year.

Tax Preparation Course What You'll Learn in Our Course

- Prepare most individual tax returns

- Perform a thorough interview with a taxpayer

- Determine a taxpayer's filing status and eligibility for exemptions

- Accurately report income and deductions for a taxpayer

- Determine a taxpayer's eligibility for credits and deductions

- Compute depreciation for assets and eligibility for Section 179

- Accurately calculate a taxpayer's refund or balance due

- Advise a taxpayer in tax planning strategies

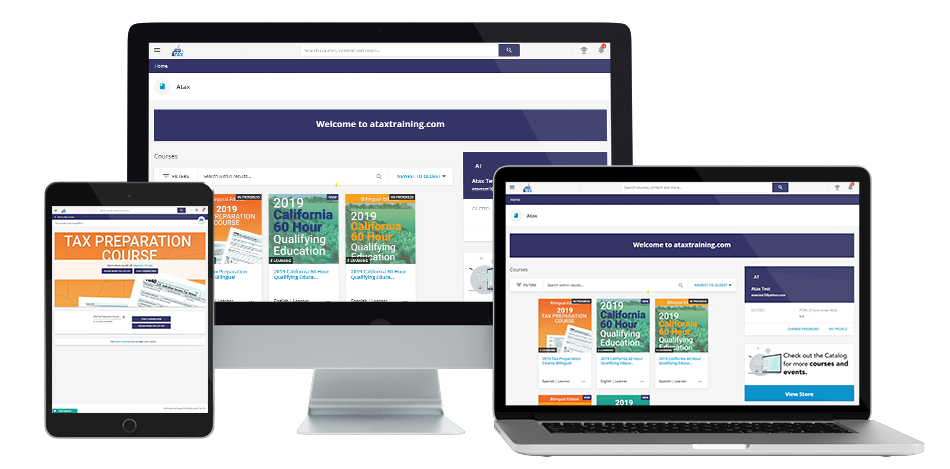

Web-based Portal

Online Portal for Tax Preparation

Practice Activities

After reading each chapter you will have to login to your own online portal to answer the review questions related to the material that you read, and to prepare practice tax returns. Also, you will be able to download the PDF practice tax return scenarios and the necessary forms to prepare the tax returns by hand. You will then answer questions related to the tax preparation.

Follow Yuderka Beltre

Meet Your InstructorYuderka Beltre

Class Leader of ATAX - West 192nd St, NY

I’m Yuderka Beltre, a proud Dominican residing in New York City and a dedicated tax professional with over 5 years of experience in the tax preparation industry. As a certified Notary Public and an IRS-authorized ITIN Acceptance Agent, I specialize in preparing individual tax returns (Form 1040), Schedule C for small businesses, and a wide range of other federal and state tax forms. In 2024, I became a franchise owner with ATAX, where I continue my mission of providing accessible, community-based tax services. I am also committed to educating others by conducting tax school programs to train future preparers.

Have Questions? Call Us Today (646) 422-7957