Register for Class Today!

Coming soon...

Or Select

What this fees includes:

- Note: Total fee must be paid prior to class sessions.

- This fee include the book and access to the online portal.

- The course offered are subject to cancellation in the event of insufficient enrollment.

- Completion of the course does not guarantee employment, nor are graduates required to work for the company.

Income Tax Preparation Course Bilingual Textbook

This course is a bilingual (English & Spanish) basic overview of tax preparation. And, it's only available in the Fall of every year. Prior tax knowledge is not a requirement to take the course. This 15-chapter book is a basic overview of the Form 1040. At the end of each chapter, you will answer the chapter review questions and prepare a practice tax return. You must complete all the chapters, the final review questions and each practice tax return to receive a Certificate of Completion for the course. Everyone that successfully completes the course, is responsible for completing a new or a renewal application with the IRS for the IRS Tax Preparer Identification Number (PTIN) before the 31st of December of every year.

Tax Preparation Course What You'll Learn in Our Course

- Prepare most individual tax returns

- Perform a thorough interview with a taxpayer

- Determine a taxpayer's filing status and eligibility for exemptions

- Accurately report income and deductions for a taxpayer

- Determine a taxpayer's eligibility for credits and deductions

- Compute depreciation for assets and eligibility for Section 179

- Accurately calculate a taxpayer's refund or balance due

- Advise a taxpayer in tax planning strategies

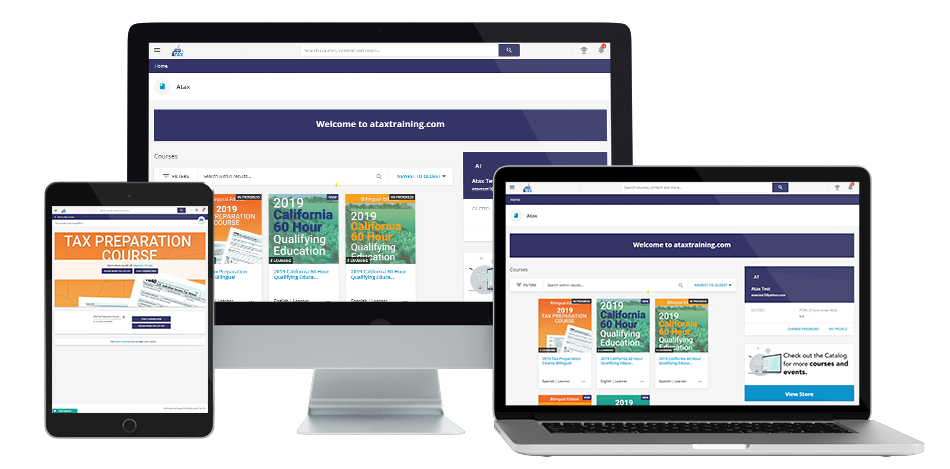

Web-based Portal

Online Portal for Tax Preparation

Practice Activities

After reading each chapter you will have to login to your own online portal to answer the review questions related to the material that you read, and to prepare practice tax returns. Also, you will be able to download the PDF practice tax return scenarios and the necessary forms to prepare the tax returns by hand. You will then answer questions related to the tax preparation.

Follow David Fabrizi

Meet Your InstructorDavid Fabrizi

Class Leader of ATAX - Barnum Avenue

David has been a CPA for over 30 years and has just opened the NEW ATAX office in Stratford! His extensive experience offers a unique learning environment for the new tax preparer. He's seen it all and can train YOU to understand the nuances of preparing taxes. Looking forward to working with you!

David Fabrizi is a CPA as well as an Attorney who works with business and individuals to offer one-stop-shopping for all of their business and personal legal and accounting needs. After 15 years of CPA work, David found that his clients regularly needed legal services. He headed back to law school and in 2001 received his Legal Degree from Quinnipiac University. Since that time, he has processed thousands of tax returns, helped hundreds of client with their tax resolution needs, and represented numerous clients in tax court.

Have Questions? Call Us Today (475) 295-2829