Register for Class Today!

Coming soon...

Or Select

What this fees includes:

- Note: Total fee must be paid prior to class sessions.

- This fee include the book and access to the online portal.

- The course offered are subject to cancellation in the event of insufficient enrollment.

- Completion of the course does not guarantee employment, nor are graduates required to work for the company.

Income Tax Preparation Course Bilingual Textbook

This course is a bilingual (English & Spanish) basic overview of tax preparation. And, it's only available in the Fall of every year. Prior tax knowledge is not a requirement to take the course. This 15-chapter book is a basic overview of the Form 1040. At the end of each chapter, you will answer the chapter review questions and prepare a practice tax return. You must complete all the chapters, the final review questions and each practice tax return to receive a Certificate of Completion for the course. Everyone that successfully completes the course, is responsible for completing a new or a renewal application with the IRS for the IRS Tax Preparer Identification Number (PTIN) before the 31st of December of every year.

Tax Preparation Course What You'll Learn in Our Course

- Prepare most individual tax returns

- Perform a thorough interview with a taxpayer

- Determine a taxpayer's filing status and eligibility for exemptions

- Accurately report income and deductions for a taxpayer

- Determine a taxpayer's eligibility for credits and deductions

- Compute depreciation for assets and eligibility for Section 179

- Accurately calculate a taxpayer's refund or balance due

- Advise a taxpayer in tax planning strategies

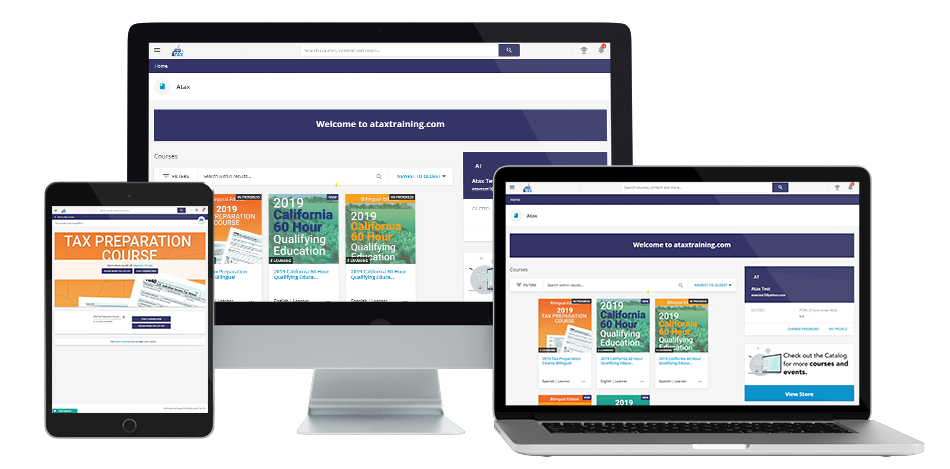

Web-based Portal

Online Portal for Tax Preparation

Practice Activities

After reading each chapter you will have to login to your own online portal to answer the review questions related to the material that you read, and to prepare practice tax returns. Also, you will be able to download the PDF practice tax return scenarios and the necessary forms to prepare the tax returns by hand. You will then answer questions related to the tax preparation.

Follow Digna Cueto

Meet Your InstructorDigna Cueto

Class Leader of ATAX - Elmhurst, NY

In the past 3 years I have graduated 200+ students, right after completing our tax school instruction the student become a first year tax pro with multiple opportunities of generating additional income or becoming a business owner. Don't miss the opportunity to join one of our sessions, available in English and Bilingual "English/Spanish".

Digna Cueto is a Business professional with 20+ years of experience in Corporate Retail. Graduating from a business plan training course has awakened the entrepreneur in her " a real passion for accounting and tax preparation field". She graduated with Engineer and Business Administration Degrees and also have completed 18 credits in Accounting Major. The support, partnership and resources from ATAX Franchise enable her to provide a high value service to target customers in Queens NY, She is the owner of ATAX Elmhurst NY. Digna Cueto es una profesional de negocios con más de 20 años de experiencia en retail corporativo. Graduarse de un curso de capacitación en plan de negocios y emprendimiento ha despertado a la emprendedora en su interior " su verdadera pasión por el campo de la contabilidad y la preparación de impuestos". Se graduó con títulos de Ingeniero y Administración de Empresas y también ha completado 18 créditos en Contabilidad. El apoyo, la asociación y los recursos de ATAX Franchise le permiten brindar un servicio de alto valor a los clientes objetivo en Queens NY. Ella es la propietaria de ATAX Elmhurst NY.

Have Questions? Call Us Today (917) 473-3275